DEAR TRUST OFFICER:

I’m intrigued by something I heard about recently, a “dynasty trust.” What is that, and how does it work? — LEGACY BUILDER

DEAR LEGACY:

Traditionally trusts with private beneficiaries were not permitted to last forever, but had to have a determinable end date. This policy was enforced by the “rule against perpetuities,” a complex formulation that was the bane of many law students. As a simplifying rule of thumb, a private trust generally had to end in about 90 years or so. Wholly charitable trusts, in contrast, could last forever.

Recently, some states have amended their trust laws, and one important change has been the lengthening of the permissible life of a private trust to 360 years or more. Some have eliminated the restriction entirely.

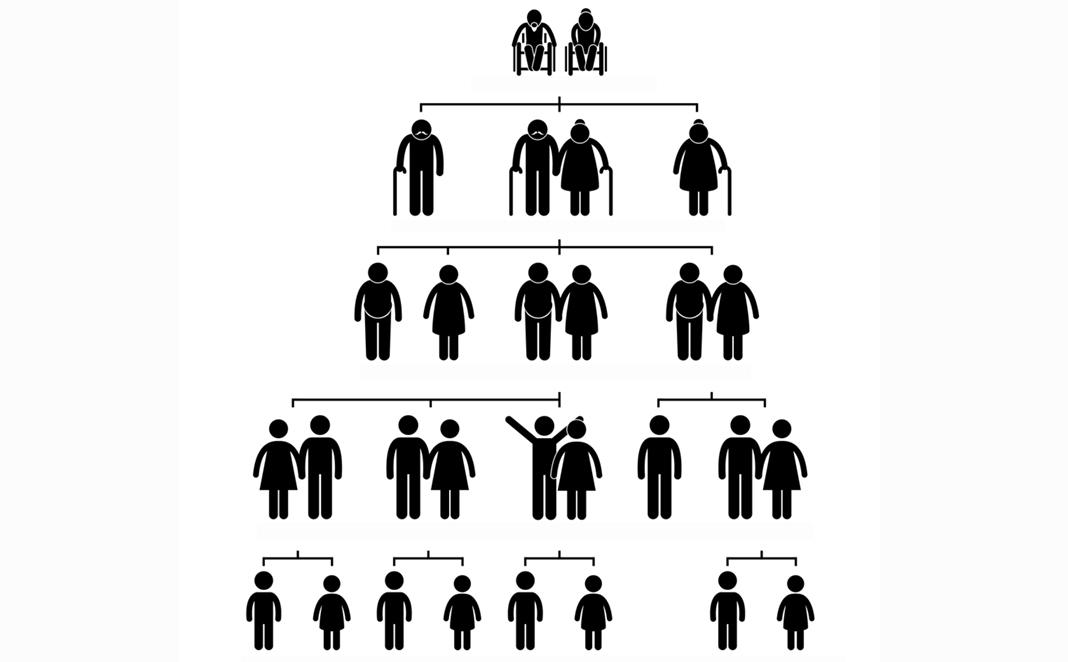

The longer life for private trusts has given rise to the multi-generational “dynasty trust.”

The other aspect is taxation. There is a federal tax on major gifts, on large estates, and on “generation-skipping” transfers (GSTs) associated with trusts. There is an exemption from the GST tax, and it matches the federal estate tax exempt amount. It is theoretically possible to put assets into a dynasty trust, sheltered by these exemptions, and have those assets provide family financial protection for generations without further transfer taxes. Income taxes still would apply.

Do you have a question concerning wealth management or trusts? Send your inquiry to RAeschliman@corefirstbank.com.

(November 2019)

© 2019 M.A. Co. All rights reserved.

Does your estate plan include The Library Foundation? Would you like it to? Contact Erin today to discuss how a gift to the Library could be included in your plan. Send us a message at Foundation@TSCPL.org